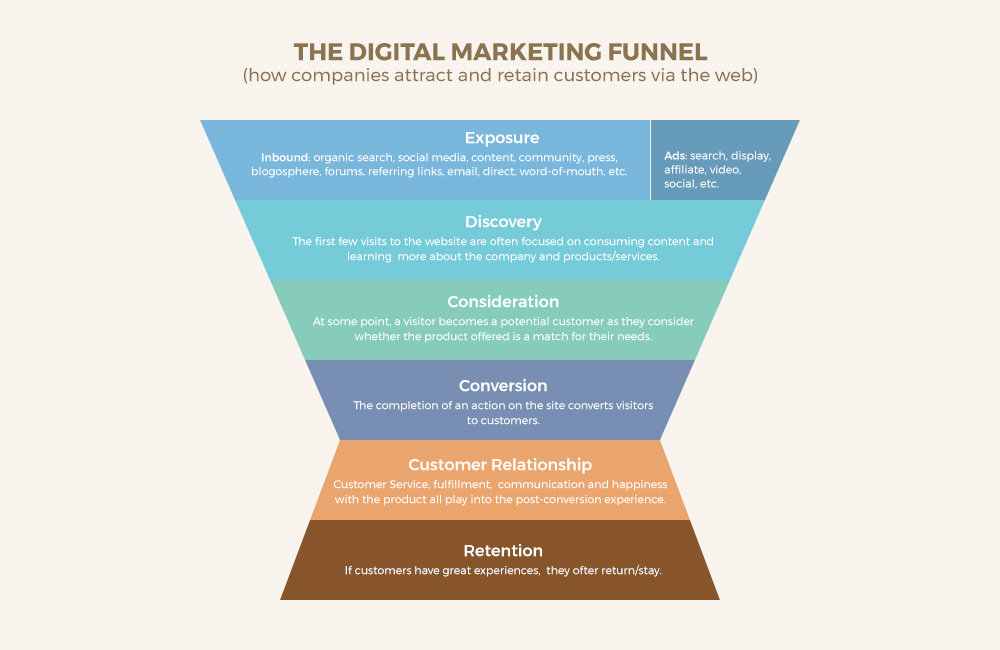

For any NetSuite eCommerce business, the Customer Lifetime Value (LTV) is what can make or break your company’s income. It is true that an important part of owning a business is making sure that you have a marketing campaign effective enough to draw customers to your products or services. However, unless you can keep the customers coming back to your company, your marketing tactics will not provide you with a good ROI: it is estimated that almost half of eCommerce transactions are from repeat customers.

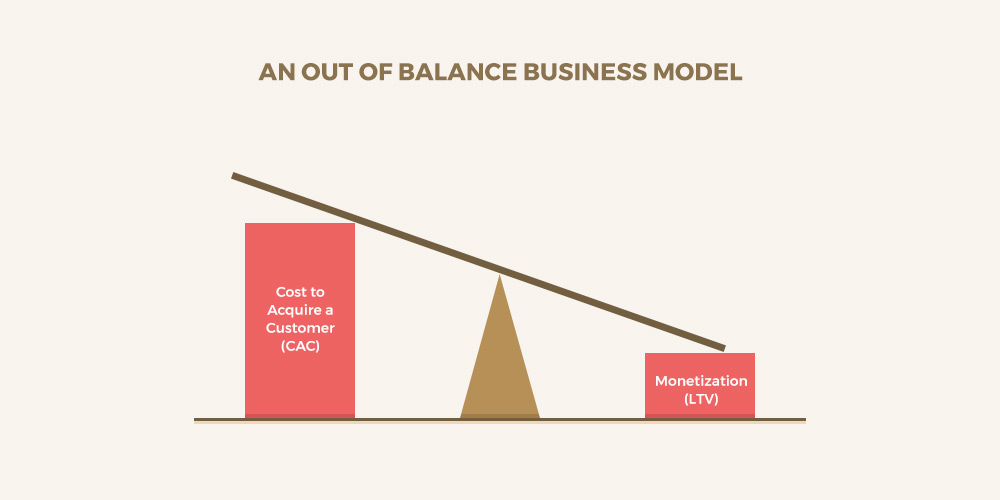

So, in order to have a successful business, your customer should spend the same amount of money on your products as you have spent on attracting that customer to your business.

Don’t hesitate to contact our eCommerce Growth Strategy experts about this!

Calculating Your LVT

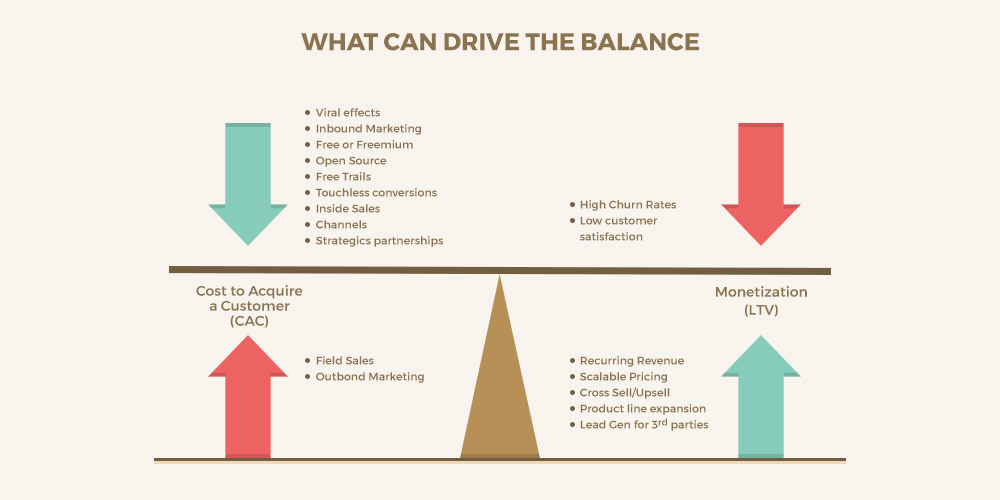

In order for your business to have a steady cash flow, your LTV should be greater than your Cost of Acquisition (CAC).

In order to figure out how much money your company spends on acquiring a new customer, simply divide the amount of money that you spend on marketing each year by the number of customers that you have acquired from those campaigns.

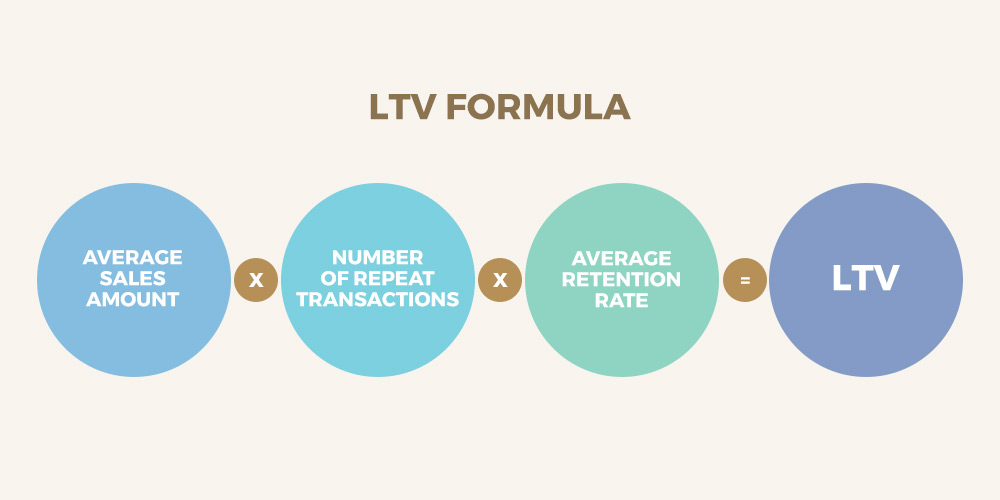

Next, in order to come up with an LTV, take your average sales amount, the number of repeat transactions, and the average retention rate, and multiply those numbers together to get your LTV. Your goal is to is to ensure that your LTV number is higher than your CAC number.

There are other ways to calculate your LTV but in order to do other calculations, you will need to know your company’s cart average, how frequently items are purchased, the customer value, and the average customer lifespan.

Without having detailed knowledge of your company’s financial history and your customer’s habits, it will be difficult to figure out what your LTV is. Look through all of your company’s relevant records with a fine-tooth comb to ensure that you are not missing any valuable information.

Beyond LTV you may want to figure out your Customer Retention Rate. In order to do that, you need to subtract the number of new customers that you have acquired during this period from the number of customers that you have at the end of the period. Take that number and divide it by the number of customers that you had at the beginning of the period. Once you have that number, multiply it by 100 and that will give you your Customer Retention Rate.

Increasing Your LTV

If the number that you got for your Customer Lifetime Value is lower than you had hoped it would be, there are some things that you can do in order to increase that number for the next period such as:

- Improve Your Customer Service Department.

- E-mail your customers an informative newsletter regularly.

- Allow your customers to buy a subscription.

- Consider focusing your marketing strategies on existing customers to ensure they become repeat customers.

There are several ways to increase your LVT. The most important thing to remember is that a customer that feels like there is value in your company, and they are valued as a customer, will be more likely to come back again and again.

Maintaining a successful LVT is a crucial part of having a profitable company. This is easily achievable with the right tools and knowledge. If you have any questions, please feel free to contact us.